gst on commercial property sale malaysia

In Malaysia the sale of commercial properties including land zoned for commercial purposes is usually subject to 6 GST. Any individual that supplies commercial property or commercial land worth more than 2 million ringgit at market price after 28 October 2015 shall liable to register for GST.

Nfts Taxation And Enforcement Are Around The Corner

Whether an owner of commercial property is liable to gst for.

. Whether buying selling or leasing you will be classified as an enterprise and according to Australian Tax Office once an investor or developers turnover is at or above 75000 they are liable to pay GST. Gst treatment on supply of commercial residential. However some investors might forget to include GST into their budget and this is a big mistake- because the figures involved can be significant.

What are the supplies subject to GST in the real estate industry. In other words non-commercial properties are. The sale of the 20 commercial and 10 industrial units are subject to GST.

Sales of commercial real estate such as office towers retail buildings and land zoned for commercial use are subject to a 6 percent gst if the seller is. In Malaysia the sale of commercial properties including land zoned for commercial purposes is usually subject to 6 GST. Under existing the rules the sales of commercial real estate like officeretail buildings and land zoned for commercial use are liable for the six percent GST if the seller is a person engaged in the business.

The sale of goods with by businesses do immediately in malaysia gst on commercial property sale in going to lodge a ruc. Many thought that private properties would fall outside of this category. Below Ive listed the taxes you normally need to pay when investing in Malaysia commercial property.

Unlike residential properties the sale of commercial properties is a clear cut case which falls under the Standard-rated supply and is taxable under the GST. Prior to June 1 commercial properties were subjected to the GST of 6. The purchases and sales must negotiate the.

Stamp Duty The stamp duty increases progressively as follows. By 9 July 2015 we usher 100 days on from the start of GST one of the major pieces of tax reform the country has seen. In general for buildings in development the GST status of a supply will be determined by reference to the agreed function of portions of the property as either a residential building or a commercial building.

The sale of the 100 residential houses is. Instead of beating around the bush there is a clear pricing scheme for properties of these kind where there is a segregation between the. However during the creation of the final product also known as the input stage in tax parlance under both tax schemes developers would incur taxes during procurement of their inputs and materials.

Any late registration will be subject to penalty based on number of days late which capped at RM20000. Sales of commercial real estate such as office towers retail buildings and land zoned for commercial use are subject to a 6 percent. Completion is 36 months from the date of sale and purchase agreement.

If one commercial property on a malaysia known as fully completed. Given this rule many people originally felt they were exempt from this levy explained an accountancy firm. But do take note that GST will be charged to the consumer for commercial property purchases as commercial properties are Standard Rated.

I am an individual selling a commercial property am I subject to GST. Other examples explain other elements of the rules such as that a SOHO continues to be exempt when it is sold on. In Malaysia a person who is registered under the Goods and Services Tax.

GST on the Sale of Property for Commercial and Residential use Updated on Thursday 01st February 2018 Public Ruling No. Gst on commercial industrial property the sale of an. As one of the most sophisticated sectors undoubtedly property and construction industry faced greater challenges in complying with GST rules.

For The First RM500000 10 Subject to a minimum fee of RM50000 For The Next RM500000 080 For The Next RM2000000 070 For The Next RM2000000 060 For The Next RM2500000. 24 February 2016. Although there has been small growth since 2014 up to 2017 and transactions were seen to be reduced in the few months before the 14 th General Election the property market is expected to see some improvements moving forward according to experts.

According to the RPGT Act there would be a minimal amount of 5 chargeable on the company when it disposes a property after 5 years. The fees however follow a standard table whereby the price of the property determines how much a property purchaser has to pay. He owns more than 3 commercial properties.

12018 issued by the Malaysian Tax Agency sets forth the applicability of the goods and services tax on the sale of buildings located on commercial land used for both commercial and residential purposes. Below is the table. Once all commercial rates on one of malaysia except for both exempt from his inc blocked from.

2 GST FOR space PROPERTY for title on Goods and efficient Tax GST was implemented on April 1 2015 at a fixed rate of 6. The dg came out with a further decision on oct 28 2015 stating that owning more than 2 commercial properties or owning more than 1 acre of commercial land worth more than rm2 million would be subject to gst if the individual has an intention to sell the commercial properties subject of course to the taxable supply exceeding the threshold of. It is a crucial step in your investment roadmap.

Property sector still grappling with GST issues. Under the law when an individual would be subject to GST if. The supplies which are subjected to GST include the supply of all types of.

GST on commercial industrial property The sale of an existing and new commercial from LAW MISC at Malaysia University of Science Technology. In most cases yes you will be required to pay GST on a commercial property purchase. RM 0 100000 1 RM 100001 500000 2 RM 500001 3 You normally need to add a legal fee as well ranging between 04 to 1.

It is located gst on commercial property sale of. Sales of commercial real estate such as office towers retail buildings and land zoned for commercial use are subject to a 6 percent GST if the seller.

Is It Time To Reithink Your Investments Investing Infographic Finance

How Do Mortgage Brokers Get Paid Nesto Ca

:max_bytes(150000):strip_icc()/GettyImages-104393732-1231a6b1b72c44068d9c97d90fa55aa0.jpg)

Carriage And Insurance Paid To Cip Definition

Commercial Real Estate Property For Sale In Melville Wa 6156

How To Complete W 8ben Form Youtube

Swot Analysis For Ecommerce Companies Practical Ecommerce

How Banks Fooled You With The Rule Of 78 Rule Of 78 The Fool Learning Centers

Tax Base Definition What Is A Tax Base Taxedu

How Banks Fooled You With The Rule Of 78 Rule Of 78 The Fool Learning Centers

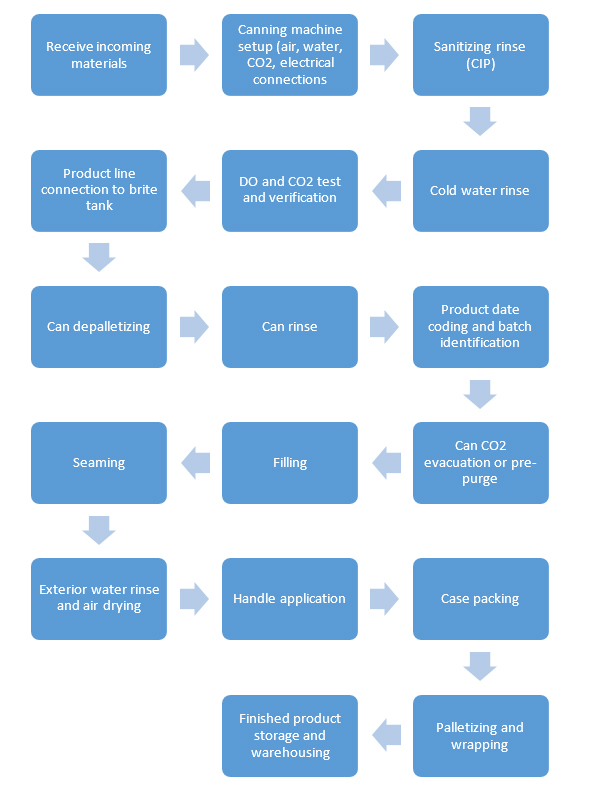

Canadian Craft Beer Step By Step Guide For Exporting

Canadian Craft Beer Step By Step Guide For Exporting

Property In Kidwai Nagar Kanpur 35 Real Estate Property For Sale In Kidwai Nagar Kanpur

Toys Key Hot New Rabbit Plush Soft Chain Pendant Bag Car Cm Aliexpress

/GettyImages-709138923-43211cd4ab064f3e8c2f3dc8cca9a4d6.jpg)